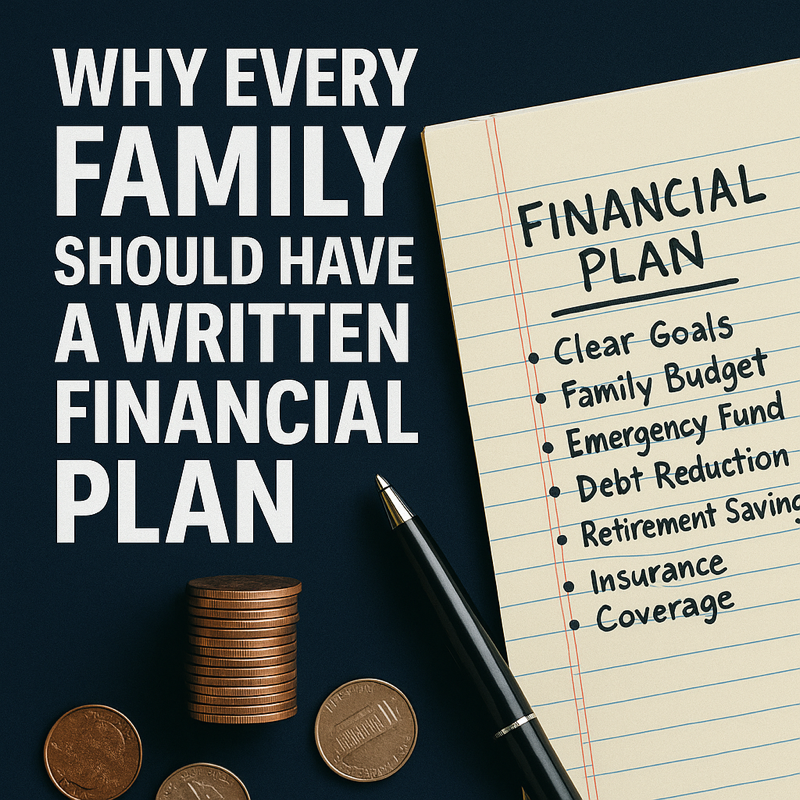

Hope is not a strategy. Too many families rely on vague intentions—“We’ll save more” or “We’ll pay off debt someday”—without a concrete plan. A written financial plan turns ideas into action.

Step 1: Define Your Goals

Be specific. Instead of “save for retirement,” aim for “save $1 million by age 65.” Specific goals are measurable and motivating.

Step 2: Create a Family Budget

A budget isn’t about restriction; it’s about control. Allocate money for essentials, savings, debt payments, and discretionary spending in that order.

Step 3: Build Your Emergency Fund

Unexpected expenses aren’t a matter of “if” but “when.” Having three to six months’ worth of expenses in reserve keeps you from turning to high-interest debt.

Step 4: Manage Debt Wisely

List all debts, interest rates, and minimum payments. Use a repayment method like the snowball (smallest balance first) or avalanche (highest interest first) to eliminate them.

Step 5: Plan for Retirement

Whether through a 401(k), IRA, or other vehicles, contribute regularly. Increase contributions whenever you get a raise or windfall.

Step 6: Review Insurance Coverage

Ensure your family is protected against health crises, property loss, and untimely death.

Step 7: Revisit and Revise

Life changes—your plan should too. Review it at least annually to adjust for new goals or challenges.

Bottom Line:

A written plan is a roadmap. Without it, you’re driving blind. With it, you can navigate confidently toward financial security.